Cost of Goods Manufactured Formula

The XYZ Factory calculates its cost of goods manufactured as. It is not needed for the perpetual inventory method where the cost of individual units that are sold are recognized in the cost of goods sold.

Cost Of Goods Manufactured Formula Examples With Excel Template

Direct and indirect materials may be included in the raw materials inventory.

. How To Calculate Cost Of Goods Manufactured. The cost of goods manufactured COGM is an accounting term that refers to a statement showing a companys total production costs within a specific period. COGM 135000 150000 35000 150000 45000.

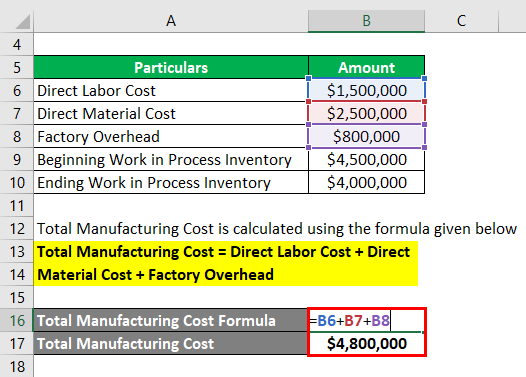

Total manufacturing cost is the total cost of materials labor and overheads incurred for manufacturing. Then the beginning WIP inventory Cost of goods not finished in the accounting period and ending WIP costs are 35000 and 45000 respectively. Beginning Work in Process Inventory 25000.

The costs for manufacturing these parts are. COGM example 2 ABC Furniture Store had 100000 in finished goods at the end of last year. Use the numbers in the formula mentioned above.

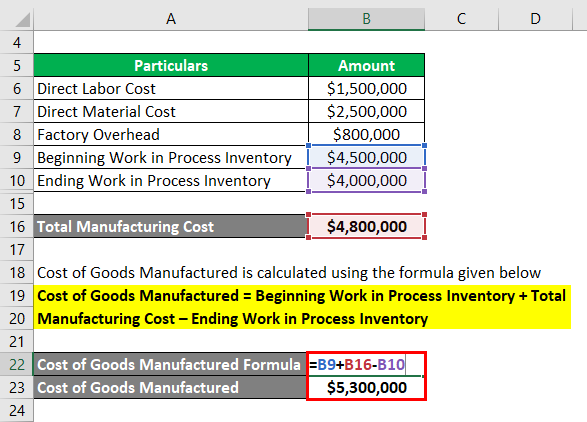

A break down of this schedule can be visualized below. Total manufacturing cost direct materials direct labor costs manufacturing overhead Each of the components that go into the total manufacturing cost has to be considered separately. Cost of Goods Manufactured Formula Cost of Goods Manufactured Beginning WIP Inventory Manufacturing Costs Ending WIP Inventory COGM vs.

COGM Beginning WIP Inventory Total Manufacturing Cost Ending WIP Inventory The Cost of Good Manufactured Schedule How is COGM Related to COGS. COGS beginning inventory purchases during the period ending inventory COGS 30000 5000 2000 COGS 33000 Accounting for Cost of Goods Sold. We can now use these figures to compute the Cost of Goods Manufactured which we will show in the following T-Account.

The Cost of Goods Manufactured COGM is a statement that shows the total cost of producing products for a company during a specific period. Ending Work in Process Inventory 35000. We will use these values in the costs of goods manufactured formula.

Per Unit Product Cost Total Cost of Direct Materials Total Cost of Direct Labour Total Cost of Direct Overheads Total Number of Units So the cost of goods that are not yet sold but are ready for sale can be recorded as inventory asset in your balance sheet. 4000 19000 - 5000 18000 The total dollar amount of inventory completed and moved to the finished goods account for that calendar year was 18000. By simplifying the above formula we can say cost of goods manufactured is basically.

This includes the cost of materials labor and other expenses. Enter the values in the below calculator and click. Cost of Goods Manufactured COGM Total Factory Cost Opening Work in Process Inventory - Ending Work in Process Inventory Our online cost of goods manufactured calculator helps you find the output.

So here is the cost of goods manufactured formula COGM Beginning WIP inventory total manufacturing cost ending WIP inventory. Using the cost of goods sold equation you can plug those numbers in as such and discover your cost of goods sold is 33000. If the manufacturing cost is high the company needs to plan accordingly to create a budget to make the most out of the annual revenue.

It then adjusts these costs for the change in the WIP inventory account to arrive at the cost of goods manufactured. Cost of Goods Sold COGS In spite of the similarities in the names the cost of goods manufactured COGM is not interchangeable with the cost of goods sold COGS. COGM calculates the total cost of converting raw materials into finished products that are ready for sale.

COGM is the total cost of everything that goes into making a product ready for sale. The formula for calculating total manufacturing cost is. Enter the cost of materials labor manufacturing overhead beginning work in process inventory and ending work in process inventory into the calculator to determine the cost of goods manufactured.

The formula to calculate the cost of goods sold is the beginning finished goods. Beginning inventory Cost of goods manufactured - Ending inventory Cost of goods sold This calculation is used for the periodic inventory method. First we need to reach the direct labor cost by multiplying what is given Direct Labor Cost 10 100 500 500000 Total Manufacturing Cost 100000 500000 60000 660000 COGM 660000 70000 30000 700000 FINAL WORDS.

Calculate the cost of goods manufactured. The calculation is.

Cost Of Goods Manufactured Template Download Free Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

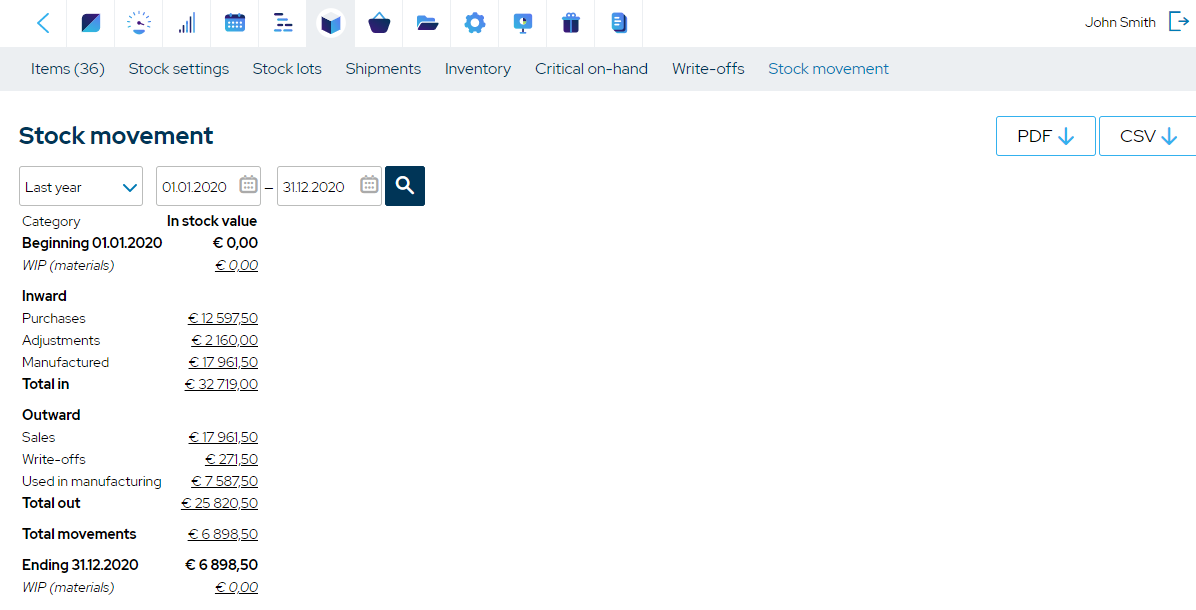

How To Calculate The Cost Of Goods Manufactured Cogm Mrpeasy

0 Response to "Cost of Goods Manufactured Formula"

Post a Comment